Investing is known as one of the most efficient ways to grow your money the fastest way possible. It’s the main strategy a lot early retirees in the FIRE community use to leave their job as millionaires. Despite this, many people never get involved in the investing world.

I can’t tell you how many people I’ve talked to who have a 401(K), but let their company handle all its set-up and investment options. After that, they don’t check their accounts, don’t pick funds best for them, or even grow their portfolio.

In this article, I’m going to walk you through how to get started in and optimize your investment accounts so you can efficiently grow your money.

Deciding How Much to Invest

In simplistic terms, the more money you put into investments the faster you’ll hit your investment goals. The trick is to figure out how much you want to put into your investment accounts.

If you already have an idea of just how much money you’ll need to live comfortably each year it would be easier to determine just what your investment baseline is. Sit down and think just how much money you want to invest each month, quarter, or year.

For beginners, it may be easiest to start out with just putting away 1% of your finances into investments. After every thirty days, increase that amount by 1%, re-evaluating every six months. This small percentage will be just unnoticeable enough to invest comfortably while still increasing your investment portfolio.

Some people find it easier to not think of the amount they put away in terms of percentage but in dollars amount. For example, if you make $4,000 a month then start by investing $40(1%) per month then increase that by another $40 each month.

Keep in mind plenty of brokers are available to open an account without needing a lot of money. If budgeted accordingly it becomes doable to invest even as a broke college student.

Saving vs Investing

Despite how both a 401K and Roth IRA have penalties for early withdrawal(before age 59 1/2), a Roth IRA only has a penalty on capital gains. Any money you deposit into your Roth is yours to withdraw at any time. Roth IRAs also have certain conditions where you can withdraw on any of your earnings so long as you are:

- Ineligible to work due to disability

- Inheriting someone else’s Roth IRA

- Buying your first house(Limit of $10,000)

- Paying for health insurance premiums if unemployed

- Paying any unreimbursed medical expenses

- Paying higher education expenses for you, spouse, or child

- Have unpaid federal taxes

Due to these exceptions, there is a divide in the FIRE community on whether one should have a nest egg or invest it all. I’m going to touch upon what I heard from each side and let you decide what to do.

Why Build a Nest Egg

- All money deposited will be untouched

- Instant access to your money when you need it

Why Invest it All

- Contributions can potentially grow much higher than in a nest egg

- Can withdraw it when you need, grow it when you don’t

Keep in mind, your Roth IRA contributions are only as good as the funds you choose. If you expect the market to go south, then putting all your savings in a Roth IRA Index Fund option will not be the best strategy if an emergency happens shortly after.

When you’re starting out, you can opt to just build a nest egg first then gradually transition it into a Roth IRA as your contributions grow. A common savings formula to use is:

monthly expenses * N

Where N is the number of months you want to have saved up. So for example, if my expenses are $3,000 each month and want 3 months of emergency funds saved, my nest egg will be $3,000 * 3 months = $9,000.

I’ve seen a lot of experts suggest a range of 3-6 months to save up, but the more financially comfortable investors have gone as little as 1 month.

Choosing an Investment Account

There are a lot of investment accounts out there, and likely more to come after this article’s posting. I won’t mention specifically which broker to go through when setting up your account but will mention just what to keep in mind when deciding one.

First off, I would always suggest you pick a broker who has a long, accredited history to their name. Be sure you check if they have a diversity of funds available especially ones with a Total Market Index Fund and International Index Fund. Lastly, pick a broker that allows you to manage your account with a low management fee(Zero-commission is ideal).

If you have a 401K then there’s a chance you are locked into whatever broker your company has chosen for you. Some companies offer you to rollover your 401K contributions to your preferred broker, so be sure to check the policies of your plan.

If you are setting up a Roth IRA, you have more free-range available in your options. Be sure any broker you consider meets the above requirements. Otherwise, be sure you research heavily in any investment accounts and plans before opening something up.

Setting Up Your Funds

When you’re setting up your investment accounts you’ll find you have a lot of funds to pick from. I would recommend investing your primary holdings in an Index Fund.

When browsing you may find two key index funds stand out: A Total Stock Market and an S&P 500. What do these two mean?

While a Total Stock Market fund allows you to invest in a small fund that owns a broad selection of the U.S. Stock market. The S&P 500 fund owns a small piece of the biggest 500 U.S. companies. The total stock market allows a little more diversification as you can invest in more companies(small, medium, and large) instead of just the top 500.

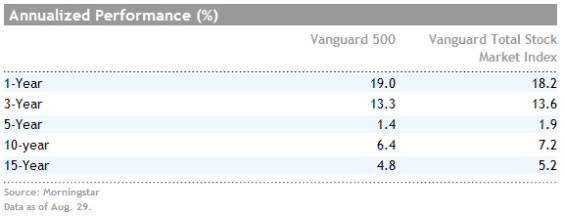

So then which one should you go for? Well, that’s a tricky question that will involve looking at some data. Let’s do a breakdown of both of these funds in the past 10 years(From 2007-2017)

As you can see, in the past year the S&P 500 index had a higher percentage return than the Total Stock Market. While in the long term the Total Stock Market had the overall higher return. Both of the differences in percentage is admittedly marginal and causes a bit of a back-and-forth recommendation among investors.

I personally am invested in the Total Stock Market due to the longevity in having higher growth, but there’s no guarantee which will outperform in the future.

There’s a third index fund that’s also worth discussing known as the International Index fund. Having a small portion of your portfolio dedicated to this fund will allow for broader diversification.

It’s worth noting the International Index Fund has a historical difference in behavior than the US Stock market. If you do invest in one, it’s better to just dedicate a small percentage(maximum of 5%) of your investments into it. If you are expecting the US market decline it can be a smart strategy to contribute less from your Total Market Index fund and more into your International.

Preparing for the Long Term

So now we got the basics of setting up your funds covered. Now let’s talk about what to do with them in the long term.

If you haven’t already done so, automate your investment accounts to do recurring investment payments. Figure out just how much you want to budget each month towards investments and fund it appropriately to your preferred fund.

Remember to check your fund’s performance, but don’t make it an obsession. Investing is a long term game, it’s expected to see some drops and peaks every so often. Don’t freak out and start withdrawing your money when you do see the market take a hit.

You want to wait it out-likely for several months to even a year- when the market bounces back before selling your funds You only lose money if you cash out during a decline until then that money is just a virtual number.

The Next Steps

So there you go! You now have begun to take one giant leap forward into the investment gains, but it doesn’t stop there.

Once you have set-up your preferred funds on your Retirement accounts, you can now aim to start maxing out both your 401Ks and Roth IRAs maximum annual contribution. If you find you still have more than enough money for investing, consider opening up a Vanguard Total Market Index fund to put any excess in there.

For more information on how to invest I would recommend checking out the investment books, Personal Investing: The Missing Manual and The Only Investment Guide You’ll Ever Need.

If you are interested in reading more articles on finances click on the Follow Button below to get the latest updates.