I’ll be direct here, investment is one of the most pivotal ways for someone to grow their money. Despite this, a lot of people are very reluctant to put their money into an investment account.

It’s not totally surprising. Often, people think that any money put in your investment account is money potentially lost. But that’s just one misconception when it comes to investing, in that there really is very little risk in it so long as you play it smart.

Why Invest?

Let me be clear, investing DOES NOT equal gambling. While both are money growers, putting your money towards investments provides you a reasonable chance to get the money back at a higher return, while gambling is solely based on luck.

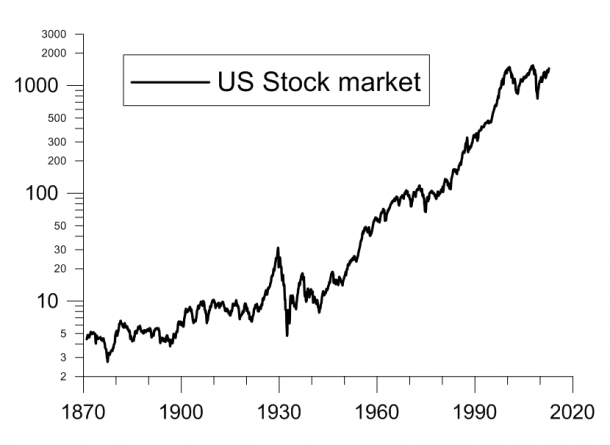

To illustrate, let’s take a look at the stock market stemming back from the 1900’s. Between then and now, the stock market has always seen a growth that averages at 7% per year. Doing the math on that, if you put in any amount of money into the market and let it sit for 10-11 years, it’ll more than double in value!

Even with major dips such as the 2008 Recession or The Great Depression, the stock market was able to make a comeback from it and grow higher than the point of the initial drop.

You don’t need to be an investment expert to get started. The important parts that influence investments stem from minimizing risk taxes, and fees, while maximizing your returns.

You also do not want to think of investment as a short-term profit. There are going to be frequent periods will you will see your money drop in value during your early investment stages, but if you hold onto your investments instead of panickingly withdrawing as soon it drops, that stock value typically will see a rise in the next couple of years.

Sounds great, right? So now let’s go over the different kinds of investment accounts you want to consider

457(b)s

This is considered by many as the best tax-advantage investment account you can have. This is a government offered plan that can be withdrawn penalty-free before reaching 59 1/2 years old, making it a great early retirement option. However, this benefit is only a government plan that’s not always offered through all agencies. If you do enroll this plan, it’s typically recommended to max it as early as possible.

401(k)s and 403(b)s

Most of us are going to employed at a company that offers either a 401(K) or 403(B) retirement account. Typically, these accounts are offered to automatically take a set amount of money from your paycheck and deposited into your account.

Many of these accounts have a 7% interest to them, so if you plan on putting something like $5,000 in there and let it sit, then that will double to $10,0000 10-11 years later. But wait, there is one advantage to these accounts that the FIRE community likes to call “free money”!

Most 401Ks and 403(B)s have matching contribution rates. Which means that any money that is deposited into your account, your employer will match a certain amount of that. For example, let’s say an employer agrees to match 100% of my contribution to up to 4% of my salary. If I were to deposit $1,000 of my salary into my 401(K) account, my employer will deposit an addition $1,000, making a total deposit of $2,000. That is quite the chunk of change just for saving!

Just to note, that when we talk about 401Ks there are actually two options here: Traditional 401(k)s and Roth 401(K). The difference between these two is dependent on what tax bracket you are going to be in.

The average person is expecting their income to be less after their retirement, so taking the tax deduction today by going with a Traditional 401(K) is the wiser choice. However, if you are planning on moving to a higher tax bracket, and make a lot more money, in the future, than it’ll be more beneficial to contribute your money to a Roth 401(K) instead.

Keep in mind that both 401(K)s and 403(B)s are pre-taxed accounts, meaning any money you contribute into them is going to be taxed out when you withdrawal. This is why you should remember that the money that is currently in your 401(K) is going to be less than you’ll when you reap the rewards for it.

However, there are other retirement account options out there that won’t penalize you for taxes upon withdrawal. One of which is what is called an IRA.

Traditional and Roth IRAs

Traditional and Roth IRAs work similarly to 401Ks, but with one key difference: Any money put in your Roth IRA is taxed BEFORE depositing instead of after withdrawing from it.

Both a Roth and Traditional IRA will also have a much lower contribution limit to it than a 401K, with the current limit(2019) being $6,000. Since IRAs are typically not offered through your company you will not find a matching contribution provided by these accounts, but many of these still maintain a 7% interest rate.

There are two differences when it comes to a Traditional IRA vs a Roth IRA. The primary difference for Traditional IRA is any withdrawal made before a certain age limit (currently 59 1/2) will be subject to a 10% penalty. While a Roth IRA does not have any early withdrawal penalties so long as you are not withdrawing the money earned through capital gains.

Similar to a Roth 401(K), contributing to a Roth IRA is dependent on what tax bracket you are in. If you earn a high-enough income you will not be able to contribute to a Roth IRA and will have to contribute to a Traditional IRA. Although, if you do make an incredibly large amount($137,000 as a single person, $203,000 as a couple) then you will not be able to contribute to either a Roth or Traditional IRA and will need to solely focus on contributing to a 401(K).

Stocks and Bonds

Let’s go back to our Why Invest section. Earlier I talked about how the market typically increases an average of 7% with any prior drop being succeeding by higher growth.

Now when we are talking about investments, there are two categories to separate this into two broad categories: Stocks and Bonds, and Funds.

When we talk about individual stocks we are talking about buying a share/shares of the company for a monetary value, which increases and decreases based on the company’s revenue.

In all honesty, buying individual stocks have some difficulty for returning a profit and is advisable that if you want to buy stocks you make sure you are buying it for the long-term and only from companies you absolutely trust in.

Remember while there are certain strategies for picking individual stocks, do not get caught up in the buy/sell cowbell advice that most self-proclaimed experts give you. Individual stock investments have their high risks to them and I would recommend just reserving to 5% of your investment portfolio towards individual stocks.

For more strategies on individual stock investments, I would recommend checking out The Intelligent Investor by Benjamin Graham.

Bonds work differently than stocks, in that they are more of a loan you provide to the company. Bonds are set with fixed purchase amounts with fixed interest rates. While stocks are bought via the market you will buy bonds Over-the-Counter(OTC).

Although they will typically have a much lower return investment than stocks can potentially provide, the risks for bonds are much lower than stocks. When choosing to buy either individual stocks or bonds, it’s generally recommended to choose bonds if you are much older and closer to your planned retirement age. Otherwise, the high-risk for stock purchases becomes easier to manage at a much younger age(e.g. 20’s and early 30’s).

However, individual stocks it’s the only way to invest in the market. Nor is it the most recommend one. Instead, if you wish to get into market investing, then I would recommend making the case for Fund Investments.

Index and Mutual Funds

Let’s breakdown the difference between Index Funds and Mutual Funds. When we talk about stock shares, each stock share we buy goes towards one specific company. In order to get the most bang for your buck, you will need to hope that the company you are in will have a high-yield stock return. This, of course, will involve a lot of time, research, and analyze to figure out.

So instead of trying to beat the odds with just one stock option, you can diversify your stock investments to a group of stocks. This will provide you with the same long-term benefit as the whole market.

Now, there are two main categories to break this down into, we’ll start first with Mutual Funds. Mutual Funds, to put simply, is a way for investors to pool their money together to have their stock shares professionally managed by an investor. Instead of having shares of the stocks, each investor has a share of the mutual fund.

The mutual fund offers a more automated approach as you are having your investments managed by a proclaimed stock market expert. However, keep in mind that the mutual fund is not typically the best route. Even professional investors who specialize in researching and talking with leading experts in specific market industries, the chances of picking the right stocks has made very little difference to an investor who doesn’t have these same resources.

This is why many successful stock market investors, such as Warren Buffet, end up putting their money towards Index Funds instead.

An Index Fund works a little more passively than a mutual fund. Instead of investing in different stock shares, the index fund will attempt to replicate the performance of a specific index such as the S&P 500 fund. If you find that the US stock market is not going to do so hot, then you can consider investing less in U.S. Stock Market Index Funds and instead put your money towards more International Index Funds.

This is great, as it allows you to divide up your investments towards a broad range of companies to closely match your earnings with stock market performance instead of individual company performance.

How to Invest

Consider all of this a start to your pathway towards investing. I want to leave off by stating that no matter which investment option you go into, you want to be sure you’re well-researched before putting your money in.

Despite how the market statistically sees a growth overall, there is still the risk that your individual investments can go south. If you want to go the safer route out of the listed options I would suggest putting your money towards your retirement accounts before taking your money into the market.

If you wish to grow your money in a shorter time-span with lower risks, then consider putting it in a bond such as The Vanguard Total Bond Market Index Fund or getting a CD from your local bank.

However, if you are looking for a riskier, but more balanced option then consider the Vanguard Income Fund, which switches your money with 60% puts into bonds and 40% into stocks.

For more information on how to invest I would recommend checking out the investment books, Personal Investing: The Missing Manual and The Only Investment Guide You’ll Ever Need.

If you are interested in reading more articles on finances click on the Follow Button below to get the latest updates.