When it comes to your finances, savings and bills is often the last thing a lot of people want to talk about. Having to a budget of every little penny earned and spent sounds like so much work, that most people wish they can put it off altogether.

Fortunately for us, there’s a way you can bundle up all your income and expenses to one neat little automated system. This way you don’t need to worry about just how much money you need to put towards every little bill and savings accounts each paycheck.

Setting Up Your Automatic Savings Plan

I’ll just cut to the chase and tell you that setting this system up will just involve one sit-down of a couple of hours.

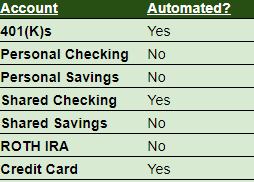

First thing’s first, take a moment to write down the list of where you have money going in and out of. Credit cards, Savings Accounts, 401(K), Checking, Bills? All that stuff goes on the list.

Next up, check which of these accounts aren’t set-up to do automated transfers or payments. For these accounts, ask yourself:

- Which account(s) are you primarily putting your income into?

- Are you putting any of that money into other accounts, such as savings, or just letting it sit in the primary account?

The third step is to determine just how much money you want to put into each item on your list. The bills definitely take precedence over here, so be sure you determine exactly how much you’ll expect to be spending on here.

Luckily for us, this can be easily figured out when determining our fixed costs!

An Easier Way to Pay Your Bills

If there’s one thing I personally detest about paying for bills it’s the obscure billing date cycles given by default. Internet bill due the 12th of the month, Credit card bill due the 26th, Netflix due the last of the month. Who in the world can keep track of all these billing dates?

To make this more manageable, try to switch your billing dates(Should take just one simple call to the company!) to occur on the same schedule. Typically the first of the month is ideal, but if you have a payroll schedule different from the normal bi-weekly one, then you may benefit from setting your bill cycle dates to take place after your paychecks are scheduled a date different than your payday.

After successfully moving your bills over to the same date, next up is to set up your bills to be paid automatically. Since you already have a clear idea of what your costs are going to be each month, setting it up to just automate the payment process will reduce your billing workload to just one simple check each month to make sure everything is processed correctly.

Let’s Automate Those Accounts

The third and final part of setting up this system now is transferring all your money to your other accounts. These kinds of accounts are not so much your 401(k)s-which automatically take money out each paycheck- and bills, but more for savings, fun money, and other investment accounts.

To fully optimize your cash flow process you will need to start categorizing just what each of your accounts is for. As well as setting guidelines on when you can withdraw and deposit from them.

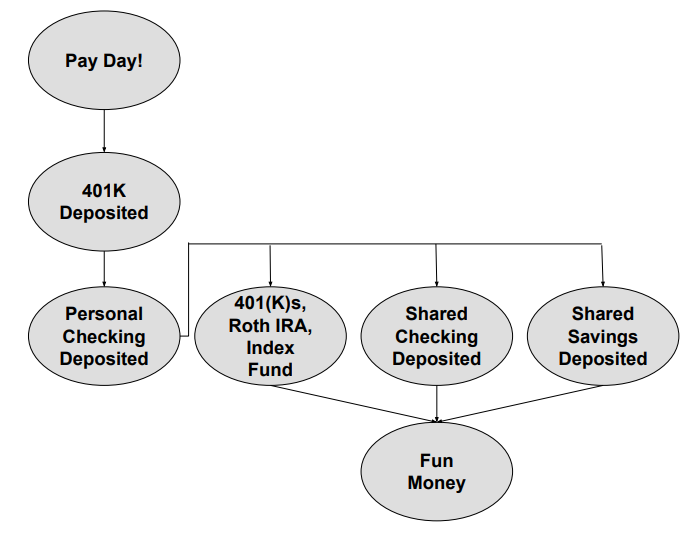

A sample set-up will use Alice as an example. Alice is married and shares a joint bank account with her husband, Bob. She also prefers to have a personal account of her own so she can still have money strictly for herself.

Bob and Alice, fortunately, make the exact same amount each year so they agreed to split everything 50/50. They plan on using their shared checking account to handle all their bills and their shared savings account to handle any long-term expenses they want to buy as a couple. Alice also wants to save up for a car but doesn’t want to make it a couple’s purchase.

Luckily for Alice, she has figured out how much she’ll need to save each month and just how much she’d like to put aside. She knows exactly how much each to put into her savings fund and fixed costs monthly. So for Alice, her breakdown is as follows:

- Alice receives a Paycheck, with a 401(K) automated transfer

- Rest of Alices Paycheck is put into her personal checking

- Alice’s fixed costs are transferred over to her shared checking account

- Alice’s transfers a % to her Roth IRA and Index Fund

- Alice’s transfers a % to her shared savings account for vacation

- Alice transfers a % to her personal savings account for her car

- The remaining checking amount is now for any other items she wants to buy such as a night out, going to the movies, etc;

This process now reduces her time for paying bills, depositing to investment accounts, and transferring to savings down to just one easily automated process that just needs to be checked once or twice a month to verify nothing’s amiss.

Awesome! We have now just simplified the process of saving and have one less thing to worry about for finances. That makes our journey to FIRE just that much closer.

To stay up to date on the latest postings for this article, hit that Follow Button below. Until then, remember to save smart, and good luck on your Prometheus’ Quest.