Saving money, like dieting, is that skill we all know is important to do, but the majority of us hate doing. But just like having good eating habits, if you don’t have good saving habits you can really find yourself in trouble. To help you get into good money savings habits, I’ll walk you through the 4 best ways to save money

In my last post, I brought up the concept of Conscious spending, an idea to spend big on things you love and drastically cut on those you don’t. While I touched upon lightly on developing a Conscious Spending plan, I didn’t really get into the meat on how to develop one.

So in this post, I want to wrap-up this two-parter on Conscious Spending by going in on best practices for developing a Good Conscious Spending Budget.

How to Fill the Buckets

Remember that when you are building a financial plan, it’s important to categorize your goals into 4 different buckets:

- Fixed Costs

- Savings Goal(s)

- Long-Term Investments

- Guilt-Free Spending

When considering this bucket, it’s important to break these costs down equally. I personally like to break them down into monthly amounts.

Remember that your Fixed Costs comes from your monthly spending on things like Utilities, Debts, Groceries, Rent/Mortgage, etc;. This is something that’s thoroughly planned out in my article, How Much is Needed to Retire.

I want to reiterate that your Fixed Costs is the most important bucket to keep filled. If you find yourself constantly struggling to fill this bucket, it means that you may be spending too much money into the other three each month and need to adjust.

Once you have a good grasp on just how much you need to delegate to this bucket, it’s time to move onto filling the second bucket.

Savings Goals

Savings Goals is the second most important bucket you’ll need to fill. These goals can also be broken down into three distinct categories:

- Short-term Goals – Items that will take just a few months to save for. (e.g. Gifts, smaller/cheaper vacations)

- Mid-term Goals – Items that will take a couple of years to save for. (e.g. A wedding, more luxurious vacations, a motorcycle/car)

- Long-term Goals – Large money items (e.g. House, land)

When you end up creating a savings goal there are two distinct questions you must ask to see which category it falls under

1. How much do I need to save?

2. How much time do I have to save it for?

This will allow you to determine your monthly budget by plugging it into this simple equation:

Monthly Goal Cost = Total Cost / Months to Save

If you find yourself having to save a lot, but have all the time in the world to do it, then great! It means you can input as many months as you would like into that equation until you find a Monthly Goal Cost that you’re satisfied with.

If you find you have a limited time to save for it than that just means you need to adjust your goals appropriately. Some goals you may not need to put off saving for until later, but at the very least you can give yourself more flexibility to save for these more time-limited goals without stressing over not having enough for other savings needs.

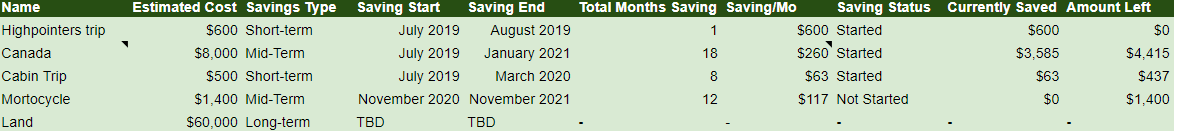

Below is an example of how I’m breaking down my savings goals if you are interested in a reference on how to get started.

Long-Term Investments

Now we dive into the third bucket, Long-Term Investments. This particular category is one of the best, but most complex, money growing strategies out of the 4-buckets.

401(K)s, ROTH IRAs, Stocks & Bonds, Real Estate, anything that you can put your money into and grow over the long term will fall under this bucket.

I won’t dive too deeply into this bucket because each investment item in this bucket has layers and technical details involved that deserve a more thorough look into as their own articles.

For now, I’ll leave it with a short summary of a common beginner strategy on investment, starting with the 401K.

401(K)s

If you are currently employed, chances are your company offers a 401(K) with matching contributions(If not, scroll down to the Roth IRA section). If you haven’t been automatically enrolled, it’s advisable to enroll immediately. While the rule of thumb for how much to contribute to your 401(K) is 10% of your income, there are many financial experts out there who suggest a more optimal strategy.

When you’re first starting out, I would suggest just contributing about 3-5% of your income and adjusts your financial lifestyle to these changes. The goal is to gradually increase this contribution by 1% every few months until you comfortably meet your employer’s maximum matching contribution amount each year.

What is the maximum matching contribution? You see, almost all 401(K)s have an annual maximum employer matching limit. A matching contribution is where your employer will take the amount you put in your 401(K) each paycheck and match whatever percentage it’s set for it. So if they have a 50% matching rate, then every $100 you put in that 401(K), your employer will put in $50. That is free money!

However, this matching contribution comes with an annual limit. If you end up putting in $18,000 in for the year, that’s great! But if your maximum matching rate is $10,000, then only $5,000 is going to be put in by your employer. That other $8,000 will not be matched for the rest of the year

ROTH IRA

If you managed to hit that maximum rate or don’t have a 401(K) option available, then you want to open up a Roth IRA account instead. While a Roth IRA does not have a matching contribution option to them, they offer certain tax advantages that the 401(K) doesn’t.

However, like a 401(K) matching maximum contribution, the Roth IRA also has it’s annual maximum contribution limits (As of 2019, that limit is $6,000). If you end up maxing out your Roth IRA contributions then you are not only doing a fantastic job at filling your long-term investment bucket, but you also need to strategize where else to put that extra money.

Other Investment Options

There are tons of different investment options out there: Stocks and bonds, index and mutual funds, real estate and refurbishing, etc; To pick the right investment option after successfully managing your 401(k)s and Roth IRA accounts comes down to a number of different personal factors.

This is why any of these listed long-term investment options mentioned in this section needs to be learned extensively before throwing your money into them. Without a thorough understanding of their risks and benefits, you could find yourself unintentionally throwing your money in a less than an advantageous opportunity.

While there are going to be more posts that go into this bucket in the future, for now, I would recommend reading up on some investment starter books out there such as Personal Investing and The Intelligent Investor

Guilt-Free Spending

This fourth bucket is not the most financially important, but definitely the most mentally important item.

When we talk about conscious spending, we have to remember that any saving and penny pinching we do is not worth it if we don’t enjoy ourselves. This is where the Guilt-Free Spending bucket comes along.

If you think about all your spending last year, think about what you found yourself spending most of your time and money on. Is it something you just love doing and can’t imagine living without? Then set-up a monthly budget for it.

The goal here is to build a system where you are still nicely filling up the other three buckets, but have plenty of money to splurge on fun hobbies. This strategy is how the author of I’ll Teach You To Be Rich, Ramit Sethi’s friend is able to spend $21,000 a year on partying while still doing an awesome job filling his other buckets.

Finding how much to put in this bucket is, of course, not something that can be figured out without setting up a plan for your other three financial buckets. Once you determine how much you need to put into your other 3 buckets, then the leftover money you have can be budgeted for guilt-free spending.

There are tons of ways of doing this, from spreadsheeting to using the envelope method. I personally like to track this through an Android app called Daily Budget. The point is, you shouldn’t feel guilty about how much you are spending on fun stuff, just remember to do it consciously.

Remember that each of these buckets will take time and experimentation to fully figure out what works best for you. In the future, I will be posting more articles that offer strategies for filling up these four buckets and link them here. For now, I will provide some of my favorite financial books so far that can help you get started on your financial journey.

To stay up to date on the latest postings for this article, hit that Follow Button below. Until then, remember to save smart, and good luck on your Prometheus’ Quest.